The City of Cleveland, Wellness Works!

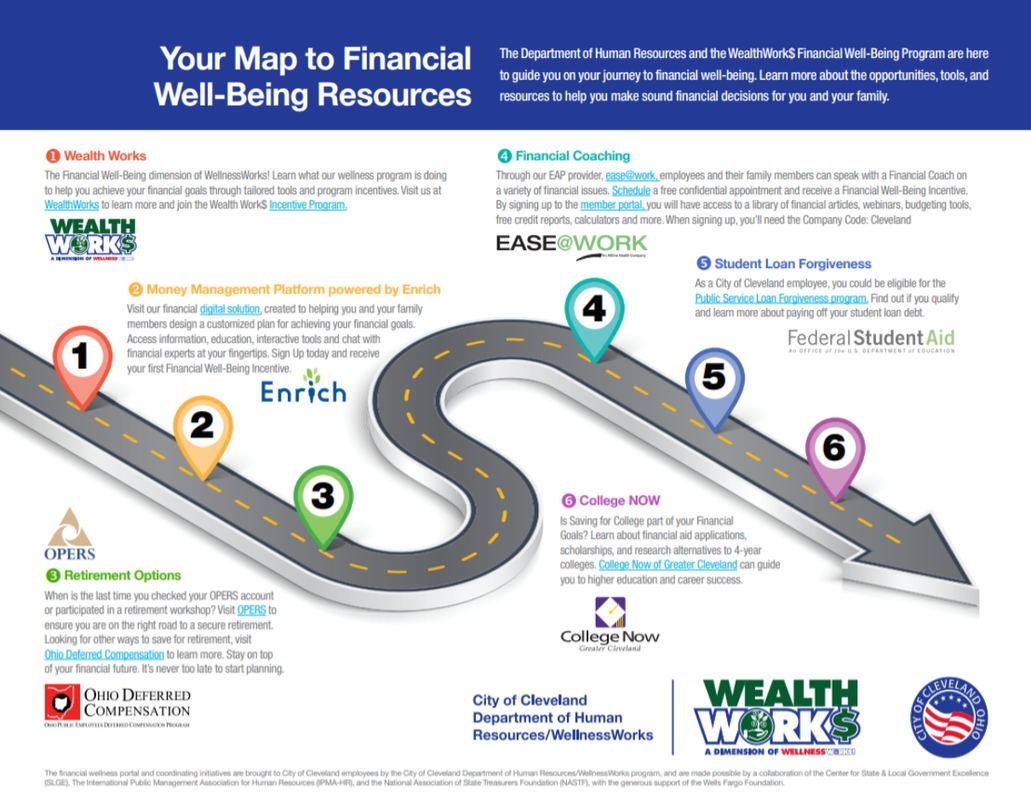

Wealth Work$ - Financial Well-Being Program

This website is a resource center for City of Cleveland employees and their families!

The goal of the Financial Well-Being Program is to assist all employees & their family members in achieving short-term and long-term financial goals by offering tailored tools, educational services and program-sponsored events in an environment that ensures easy access, user-appropriate content, on-demand information, and protects confidentiality.

Wealth Work$ - Financial Well-Being Program

This website is a resource center for City of Cleveland employees and their families!

The goal of the Financial Well-Being Program is to assist all employees & their family members in achieving short-term and long-term financial goals by offering tailored tools, educational services and program-sponsored events in an environment that ensures easy access, user-appropriate content, on-demand information, and protects confidentiality.